|

INDIVIDUAL ACTION

PLAN Nguyen

Thi Hien Chi

State

Bank of Vietnam, Vietnam ACTION

PLAN FOR MICRO CREDIT

1.

Background of Microfinance as well as participant’s Institution State

Bank of Vietnam takes past in microfinance activities in terms of setting

up legal framework for these activities and institutions that practice

microfinance activities. Microfinance

is very popular in Vietnam now, many institution practice microfinance in

many provinces all over in Vietnam but there’s still non-legal framework

on the field 2.

Other’s As

planned, we, State Bank of Vietnam, will submit the final draft of

microfinance framework to Prime Minister as well as to other members of

Government as the last step in processing the legal document in 4th

quarter of the year 2002. Legal

framework on Microfinance maybe approved as a single document, otherwise

it will be a part of another legal document, legal framework on banking

activities of institution other than credit institutions. The process of

this document might take a longer time of setting, submitting and

approving. As

I know, the draft of a legal document on microfinance is also in

processing in Indonesia. I hope that we can exchange further experiences,

facts, ideas for a better practice of microfinance in Vietnam as well as

in Indonesia. BRI

can provide TA and training for SBU’s staff in field of practicing

Microfinance activities, fact – difficulties (especially in the lack of

a legal document regulating these activities). BRI can also help SBU in

contacting with relevant government bodies in Indonesia to exchange

experiences regarding Microfinance and Regulating Microfinance as well as

experiences in setting up a legal framework on this field. -

If the legal document on Microfinance in Vietnam is approved by

Government in 2002: *

Dec, 2002 – early 2003 :

Training for SBU’s staff on Microfinance activities; on shifting

MFI into formal ones *

April 2003

: Implementing Regulations on Microfinance all

over Vietnam, on all Microfinance activities

and MFIS -

If the legal document on Microfinance will not be accepted as a

single legal document, we will insert Regulations on Microfinance

activities in the legal document on banking activities of institutions

other than credit institutions (as mention above): -

4th quarter of 2002 : Complete the final draft -

1st quarter of 2003 : Submit the final draft to the Prime Minister and other

members of Government -

During that time : Fieldtrip

to other countries to get further understanding on Microfinance practice

and how other countries regulate these activities. Loch,

Riem Deth Department

for Rural Economic Development Ministry

of Rural Development MICRO

CREDIT SCHEME IN

CAMBODIA I.

BACKGROUND

Cambodia

is one of developing countries in the region covering a surface of 181,

035 km2 with a total population of 11.7 million people,

equivalent to households. 85% of the population lives in rural areas where

farming, fishing and traditional crafts are the daily business activities.

The royal Government of Cambodia gives top priority to its social

development programme for poverty alleviation in rural areas and uses all

means and resources for the rehabilitation of economic development in

order to raise living standards of rural people. Therefore the government

has introduced a key mechanism for poverty alleviation. It is support and

strengthening of microfinance services in rural areas through the Rural

development Bank and International Micro Credit Operators (MFOs) for

provision of credit services in support of agriculture and rural economy

based on free market for development, efficiency and sustainability. PRASAC (Programme de

Rehabilitation et d’Appui au Agricole du Cambodge) means support

Programme for the Agricultural sector in Cambodia. PRASAC started in 1995

as a European Union (EU) Sponsored Cambodian emergency relief and

rehabilitation programme in Six provinces. The Cambodian counterparts are

Ministry of Rural Development, Agriculture and Rural Development Bank. The

first phase of PRASAC was in 1998 named PRASAC I and has ended in April

1999. PRASAC II, the second phase, run from May 1999 until December 2003.

Finally Credit scheme of PRASAC was renamed into PRASAC CREDIT ASSOCIATION

or PCA, to be licensed with the ministry of interior and registered with

the National Bank of Cambodia to be Micro Financial Institution (MFI). II.

OBJECTIVES

III.

OPERATION OF MICRO CREDIT SCHEME OF PCA There are two main loan products

of PRASAC Credit Association (PCA): 1.

Group Loan: Character based (village) group

loans (guarantor groups of 5 – 10 persons). The villagers are organized

in guarantor groups in order to access loans for income generating

activities without the need for collateral. There are two models of Saving

& Credit Associations as group loan delivery mechanism: Model

1: This loan product is tailor made

for villagers who form solidarity groups for the single purpose to gain

access to group loans. The solidarity groups guarantee for each other by

peer pressure without need to provide physical collateral to PCA. Group

members decide who joins the group. They elect their group leaders who act

as contact persons for loan processing. Model

2: SCA model 2 is a village level

financial intermediary that manages its own internal funds. Member are

encouraged to save monthly a

minimum of about 0.1 $ to 0.2 $ to build up the internal fund. The

internal fund is further capitalized by:

1.1

Procedures to process group loans: -

First Stage:

Branch manager and responsible Credit Officer visit the field to ascertain

the operational area, to detect the economic potential, client needs and

requirement, living conditions, main occupation (like rice growing) or

existing competition of NGO’s or other Credit Provides etc. -

Second Stage: After positive decision to activate a

operational area, the Branch manager shall visit the local authorities in

order to have PCA recognized officially as credit provider. PCA explains

to all officials on villages, commune and district level its objectives,

policy, procedure mission and vision. -

Third Stage: after

written permission from local authorities, credit shall create a specific

plan how to explain to the villagers the objectives and policy and how the

people of the district, villages can have access to loan from PCA. In

specific meeting sessions at village level (at 3 to 4 before actual loan

processing) PCA staff explain all details about loan size, loan circles,

loan duration, interest rate, guarantee etc. -

Forth Stage:

Processing of loan application forms. PCA credit staff together with SCA

committee and group leaders shall set a date to process all loan

application in the village. All loan applicants are required to have their

application verified with their thumb print on the form. After completion

all forms must be handed over to PCA staff to complete process at

responsible PCA branch. -

Fifth Stage: Loan distribution in the village.

The loan disbursement will be authorized by the PCA Branch loan committee.

PCA Credit staff will together with respective SCA committee /group

leaders set a date of loan

distribution a village grounds. Every group member must verify with

his/her thumb print the actual receipt of the loan principal.

2.

Individual Loan: The target clients for individual

business loan are micro entrepreneurs operating in rural and semi –

urban economy of Cambodia. Target clients are producing (or offering

services) in rural and semi – urban

markets. PCA gives priority to

entrepreneurial activities that are linked to the agricultural sector,

such as veterinarian services, manufacturing of farm tools, repair of farm

tools and equipment, trade in farm inputs and produce etc. However, PCA is

also targeting clients engaged in non-agricultural sector in order to

diversity its portfolio and the corresponding lending risks. 2.1 Procedures to Establish Individual Loan: -

First Step: The credit officer responsible for the designated area

will visit the prospective individual clients. During the first meeting

PCA credit staff will ask general questions to find out whether the future

possible loan should be classified purely as individual loan or qualifies

as small and medium enterprise loan. -

Second Step: The second meeting with the potential client PCA

credit staff will check the loan application form, certify ID cards and

assess the business and cash flow plan of the applicant. PCA staff will

also remind to the clients about loan conditions and ask the client to

meet at his/her house to check his/her activities within maximum 3 days.

Within that time PCA staff will visit local authorities to verify

applicants residential status, identification, family registration cards

etc. -

Third Step: The loan conditions (including amount, interest rate,

duration, collateral, guarantor family and outside) should be discussed

and finalized. All documents have to be passed to Branch Manager for final

decision. If decision is positive all legal verification and loan contract

documents have to be arranged (thumb prints). -

Forth Step: PCA staff informs the prospective client about the

positive/negative loan decision. More discussions might have to follow on

Branch Managers level In case of a negative decision. In case of a

positive decision a date has to fixed for loan disbursement. At the time

of loan disbursement in PCA Branch Office, PCA credit staff should again

explain loan procedures, especially repayment conditions of principal and

interest. IV.

PROPOSE MICRO CREDIT SCHEME According to the situation of

micro finance in Indonesia and Cambodia, there are many points that are

different. But we have some common status, products, principal’s etc.

through the training course, we have got new concepts and good experiences

from BRI to improve micro credit scheme in Cambodia. It means we will

select all good successful mythologies and strategies of BRI that there

are no in Cambodia so that the Cambodian micro credit scheme could get

success in implementation and improve. V.

TIME FRAME & IMPLEMENTATION Depend on the policy of government

on micro credit scheme we need much time to change experiences each other

for successful implementation. The action plans for implementation in

Cambodia are: -

To extend micro financial services; -

To reduce interest rate; -

To encourage wide competition among micro finance operators to

reduce interest rate and operate more efficiently and sustainable manner; -

To promote domestic saving mobilization; -

To promote local authorities to act as facilitators in coordination

and cooperation with micro finance operators; -

To include good experiences that get from BRI or training in micro

credit scheme. Tabrani

Yunis Centre

for Community Development and Education (CCDE), Indonesia 1.

Center for Community Development and Education (CCDE) is a local

NGO in Aceh. It was established in November 30,1993. The painful life of

women who have less access. Forward natural, economic, education, politic

and gender injustice encouraged 3 founders of CCDE established CCDE. The

existence of CCDE is to response the painful condition of women’s life

in Aceh. Therefore, is set two main programs for empowering and

strengthening women in Aceh. CCDE

provides social services and financial services -

The social service includes, training and other educational

activities -

The financial service is by providing micro credit for 28 women

group in four districts in Aceh 2.

The objective of Micro Finance Programs are -

To alleviate poverty -

To Empower and strengthen women in small business -

Creating employment 3.

CCDE has been provided micro credit scheme for woman through women

groups. CCDE sets the micro credit schemes with women in democratic nuance

-

Small scale loan -

No collateral -

Fast -

Etc Proposal micro credit

scheme which will be enhanced

CCDE ACTION PLAN 2003

Marasembi,

Henry, Mr. Small

Business Development Corporation PROPOSED MICROFINANCE AND

EMPLOYMENT PROJECT

BACKGROUND AND

RATIONALE 1.

In the Government National dialogue and Medium term development

Strategy (MTDS) and its recently adopted Small and Medium Enterprises (SME)

policy, the private sector development is defined to play a paramount role

for the future of PNG. The next step is to address the weakness of the

existing financial system in order to improve the provision sector. The

expected changes in relevant legal framework therefore need to emphasize

enhanced economic integration on micro and small enterprises as well as

for those who want to save money for their future financial needs. Since

the commercial banking sector does not cater for the poorer strata of the

population, which is the majority, the demand for services bye the less

affluent remains an attended a number of attempts have been made by

NGO’s government departments and the donor community to addresses this

issue. Various type of micro credit schemes have been piloted but with

rather limited success. Most of them have been established on an adhoc

basis without qualified staff and sufficient resources. Very few know of

each other existence and all try to reinvent the wheel. Four of these

schemes is the supply of credit. Saving are not mobilized. In addition,

PNG banking regulation only permit deposit taking by institution that hold

a full banking license and micro credit schemes are not in the position to

fulfill the relevant requirements. In

this connection, a draft micro finance poling was drawn up by major

stakeholder to provide a conducive framework for existing and future

institutions either upgrade existing credit schemes or downscale financial

products. The objective of the proposal micro finance policy is to

establish a framework that leads MFI’s towards enhanced institutional

capacity, and better access to refinances mechanism in order to support

the development of formal and informal enterprises and the population

currently excluded from mainstream financial services 2.

Objectives & Scope The

Project our all objective is to contribute to economic growth through

private sector development and employment creation and the further

development of the financial system. The specific objective of the project

in to provide sustainable microfinance services to viable formal and

informal enterprises and saving service to the population at large. The project

comprises three broad components/output: I)

Capacity building of MFI’s through a micro finance competence (centre)

or seeking BRI micro credit technical assistance in training II)

Development, testing and implementation of new saving and loan

product and delivery methods III)

Provision of a revolving refinance facility The project will operate nation – wide. My institutions objectives attached (refer appendix #1) 3.

There are some NGO’s operating some micro credit programmes which

are uncoordinated, and monitored so there is so lack of available

information 4.

The proposed Micro Credit Project in consultation with SBDC and BRI

NAM to provide technical assistance and further training Attached

in proposed action plan and implementation programme

ATTACHMENT

#1 1.

Background of (my) Institution Small Business Development

Cooperation. Introduction

The

small business development cooperation became operational in 1992 and is

mandated, through the SBDC Act. 1990 to assist Papua New Guinea no start

and improve small – scale business for employment creation and to

improve the standard of living in the country. Goals/Objectives

Eni

Astuti Skill

Improvement and Life Quality Foundation of Archipelago, Indonesia THE

ACTION PLAN ENCOMPASSES I.

Background Yayasan

Pengembangan Keterampilan dan Mutu Kehidupan Nusantara (Skill Improvement

and Life Quality Foundation of Archipelago), is a Jakarta based NGO whics

was established in May 27, 1986. its mission is active in improving the

quality of life of poor people in Indonesia. To

obtain or reach the mission. Yayasan Pengembangan Keterampilan dan Mutu

Kehidupan Nusantara (PKMK Archipelago foundation) provide two main

programs

PKMK

Archipelago foundation also provides micro credit for women who want to

take a course or training at PKMK Archipelago foundation. II. The Objective of

Micro credit -

To Increase women’s income through their skills an micro credit

that they received -

Employment -

Preparing skilled and trained workers III. Scheme The

micro credit is distributed to the participants of the course who have

full field the requirements needed. The repayment after having a job

needed is monthly. IV. The proposed

activities and time framework/implementation The

proposed micro credit scheme which will be enhanced are as follows:

Rachman

Windhiarto SPEKTRA,

Indonesia 1.

Background Ø

With

35 million inhabitant, East Java province still holds poverty problems of

5 million people and 600.000 unemployment (2001 statistics). In Surabaya

the capital city of East Java with 3.5 million people, there are 100,000

poor people and 57,000 unemployed people.

Ø

Low

level of skill of the poor community is still in existence Ø

There

is no access to Ø

The

presence of money lender which charge 10-20% interest permonth. 2.

Objective To

provide sustainable financial services for the poor in order to enable

them to enhance their welfare through a self-help approach 3.

SPEKTRA has been running Micro Finance programme since 1995 Ø

Training

for the poor on how to get access to capital from the banks Ø

Training

the poor on organizing their community Ø

Providing

fund up to the amount of Rp150 million for saving and credit 4.

Action Plan Ø

Reorientation

of sustainable micro finance programme to the staff as well as

beneficiaries. Ø

Training

programme for field staff by applying business approach method covering

the subjects of credit analysis and micro finance financial analysis. Ø

Training

on organization management and financial management for people community. Ø

Assisting

the community in getting access to banks Ø

Looking

for other financial resources in order to improve micro finance services. 5.

Action Plan

Bun

Chanty National

Bank of Cambodia, Cambodia As,

I m working in The National Bank of Cambodia (Central Bank) as the

authorized to the Micro finance in Cambodia. I just would like to inform

you about the micro finance in Cambodia The

micro finance in Cambodia just start from 1993 at the end of the year

2001. there are over one hundred rural financial institutions, but most of

them are very small. It have a few institution that cover for 84% of loan

(36 musd) and 81% of saving (3 musd) like: -

Acleda Specialized Bank -

Two License Microfinance Institution -

A few registration institution The

structure of microfinance Cambodian

rural financial institutions have adopted different outreach structure,

but they mostly fall into one of following three model:

ACLEDA

is only one in Cambodia that it have the most extension network,

including commercial bank Acleda operates in 15 province, and have

64 office

This

model usually consists in setting up by local structure at the village

level with the support and sometimes

direct participation of local authorities

It’s

the model that combines a limited branch network with some form of village

associations. As

the Asian Development Bank research, Cambodia need about 200 MUSD

for micro credit, but at the end of year 2001, it have only 36 MUSD

outreach to the rural area (about 400,000 families and 22% of total

needed. The

National bank also issue some regulation for supervised te microfinance

institution such as:

Daisy

Or

DEW

Credit Co Operative Ltd, Singapore ACTION

PLAN Background Micro

finance is an attractive tool to help low income households since it is

widely seen as improving livelihoods, reducing vulnerability and

processing social as well as economic empowerment. Government

and International organization in many developing countries are now

carrying out microfinance operation.

According to the Micro Credit

Summit campaign Report (2001)

it was mentioned that of the estimated 1.2 billion people living in

absolute poverty around the world, more than two – third are in Asia.

There are 3500 member institutions in the Micro Credit Summit Campaign, of

which nearly 1000 members are in the Asia Pacific Region. Of the 10-4

million poorest clients reported by the Asian Micro Credit Practitioner in

1999, 8.3 mio are women. The

four core themes of the summit campaign were reaching the poorest,

reaching and empowering women, building financially self – sufficient

institutions and ensuring a positive, measurable impact on the lives of

clients and their families. Micro

finance was therefore evolved as an economic development approach intended

to benefit the poor people and self employed activities. Micro financing

has emerged as one of the strategies for income generation in Asian

countries as well as worldwide AACCU (Association of Asian Confederation

of Credit Union) is an example, using flexible guidelines and

entrepreneurial spirit. Banks,

NGO, Credit Unions and Co-operative are the major forms of microfinance

encompass the following features:

intermediation. Singapore,

unlike many other countries in the Asia – Pacific region is an urbanized

island with no agriculture. Co-operatives in Singapore do not have to deal

with outgoing issues such as political patronage, member manipulation,

collusion, etc. In order to sustain and continue the growth and people’s

environment in the co-operative and the micro finance scheme’s, there

will be greater competition amongst providers.

Competitive interest rates and better financial/social service would

ultimately benefit client/members. DEW

Credit Co-operative Ltd. Established

on 23 July 1981 with only 19 members as DEW (development of Economy of

Women) Co-operative Credit Union. It was the vision of the late Mrs. Julie

Pan who saw the need to introduce the concept of credit union to the

Singapore women. Women in the late 70’s were making significant impact

and contribution to the economy of the nation but had limited places to

turn to for financial assistance as banks/finance companies do not

consider women as viable economic entities. Hence, they had to borrow from

tontines, club fund and unscrupulous loan sharks. Having attended the

United Nations Mid decade for women in Copenhagen in 1980 and having heard

about the marvelous work of credit unions in other parts of the free

world. She set her mind to establish a co-operative with the purpose of

helping women to Develop Themselves into Economically Independent Persons. Thus,

with a capital sum of S$ 190, a donation of S$ 300 from a generous member,

a S$ 20 manual typewriter, DEW was inaugurated. From that small start, DEW

has leapt into the 21st century to become a multi-million

dollar concerns. More importantly, it has assisted many women in their

studies, careers, businesses, family crises emergencies and even life

threatening moment. In 1995 its name was changed to DEW Credit

co-operative Ltd. to reflect the uniqueness of its organization. It is

first a co-operative operating under the co-operatives principles and

philosophy and then a financial organization offering credit to members. The

women of DEW see financial independence and continual personal self

development as a springboard to total emancipation of women. In August

2000 women member decide to provide similar opportunities to the men

associate members. As such, men can now avail themselves to the credit

facilities and social activities offered by DEW. To date DEW has assisted

more then 1,500 women and 30 associate members. Members

of DEW have benefited socially, economically, financially and spiritually.

The professionals, homemakers and self employed account for 7% each whilst

the rest are juniors or middle management position in the administrative

sales, marketing, teaching and business professionals. Hence it can be

seen that Micro financing in Singapore have been serving the following

purposes

A.

Objective of DEW 1.

To continue to play an important role to improve the economic and

social well being of all member by encouraging thrift by helping

themselves to save regular 2.

To build the financial strength, including adequate reserves and

internal control that will ensure continued service to members 3.

To promote education of the member along with the public in general

in the economic, social, democratic and mutual self help principles. 4.

To co-operate with other co-operative and their associations at

national, regional and international levels in order to best serve the

interests of their members and their communities. 5.

To create a source for credit for the benefit of member at a fair

and seasonable rate of interest for income generating project, housing

improvements, education and consumption purposes. 6.

To promote welfare and social active to society 7.

To train members especially women to become entrepreneurs 8.

To provide networking to these women to enable them to have access

to micro financing and access to free business advisory services. B.

Target Costumers: members both men/women from all walks of life,

age above 18, not a bankrupt, must be Singaporean or PR and through

recommendation. Orientation for before being approved as members. C.

Approach: - Individual lending only D.

Credit handling look: - loan interviews, assessment on repayment

capacity through financials, financial counseling, quotation, loan

training, education, home visits and telephone conversations E.

Collaterals: - Personal guarantees from friends, family members,

relatives, guarantee to open savings account with DEW or be members of

DEW, deposits/savings NTWC default insurance policy. F.

Repayment periods :

1. From 1years to a max 4 years

2. 5 years – Board approval required G.

Loan Amount

: 1. First time – up

to max of 3-month salary

2.

Repeat loans 6 months – max 8 months salary for excellent performers H.

Approval Authority :

1. Delegate Authority as set by the Board of Directors

2. Any amount about S$ 22,000

requires credit

committee (majority) approval I.

Loan Monitoring :

1. Daily follow up by reminder

2. Follow up with house visits

3. Interviews/counseling before disbursement of loan

4. At credit committee level

5. Supervisory audit

6. Annual audit by external auditors

7. Training of staff

8. Credit manual policy J.

Committees in Co-operative :

1.Education Committee – orientation meeting

2. Investment Committee

3. Credit Committee - monthly

4. Board meeting – monthly

or extradionary meeting for urgent matters

5. Supervisory Committee K.

Incentives/Award

: 1. Good savings customer

2. Good Borrowers Existing

Schemes/Activities in DEW to member 1.

Financial Counseling/loan training 2.

Budgeting for individuals/business & finance management 3.

Loans types: a.

Special Loans: education, renovation, debt settlements, working

capital, equipment, purchase of assets, start up business, upgrading, and

travel loan. b.

Ordinary loans: schemed by cash, deposit or saving 4.

Savings a.

Compulsory -

500 at time of joining as a member. Dividend paying etc. only allowed to withdraw upon registration

- Can be used as a loan for emergency/urgent cases b.

Voluntary -

Any amount, anytime

- Savings of at least S$ 1.00 included in the installment

amount – act as cushion, and for emergencies

- Interest earning. Have been payging at least 3% usually

higher than the Banks. c.

Time deposits - Term of 1 year

– Amount minimum S$ 1,000 max S$

100,000. international rate is higher than bank. 5.

Training, workshops & seminars to the economic/social well

being of members/public 6.

Loans to lower income group without credit access

- hawkers, loans to housewives and small business 7.

collaborated with lady trainer provider 3R holidays for

entrepreneurship training. How to start and run your own business 8.

assist members who are retrenched/displaced to look for jobs. 9.

Proposed Schemes (PS)/Projects in the Pipeline/Existing Project

(EP) I.

To work with interested countries in starting a pilot project on

“how to start and run your own business” workshop and simulation

course description of proposed scheme.

This

is in collaboration with 3R holidays. Lady

training provides. 2 days workshop for a class of 30

people.

This

project is currently funded by our gout

–

Unemployed, housewife – 100% subsidized

– Employed – 80% subsidized

– Registration for S$20 II.

Enhance training an Micro financing/schemes from other countries

coming to Singapore

–

Further develop training and skills, loan management and control

–

A follow up of this regional training III.

Web-based credit co-operation system

–

7 credits co-operations – sharing the NMC system

–

Better networking and monitoring loans

–

Interface of accounts in organization IV.

Business Advisory Committee/Group

– Member from the

co-operation as consultancy to new and existing business

V.

Succession Planning for Credit Committee

– New ideas, from younger members

– Better control and good for members to understand credit

– As observers in credit committee meetings

Dao

Mai Hoa

Vietnam

Women’s Union, Vietnam VIETNAM

WOMEN’S UNION 1.

In the Vietnam : the financial services are provided by 2 sector

-

the formal sector (banking system)

-

the informal sector (mass – organizations)

The informal sector provide small loan size for the poor people,

particularly in the rural areas, where the outreach of the formal sector

remains limited 2.

The objective of the micro finance program in Vietnam 3.

Vietnam Women’s Union (VWU) is the biggest women’s organization

in Vietnam, has undertaken a range of programs to mainstream women in the

development process and empower them in various areas. Of which, economic

empowerment is on a top priorities. Since

early 1990s, the operation of micro credit bye VWU has been widely spread

across Vietnam outreached many poor women in the rural. 1.

The target groups

: Poor women in the rural area 2.

Economic sector

: Agriculture, services, small enterprise 3.

Size of loan

: Small, fixed amount for every borrowers 4.

Non – collateral 5.

Interest Rate

: 1%/month (…) 6.

Monthly Repayment (Principal + Interest) 7.

Lending Scheme

: Group 8.

Transaction of loan disbursement and collection: excute in the

group

The software system manages these transactions in the base of each

individual account 9.

Weakness –

Skills on mobilization of savings (need the training) –

Knowledge on loan investigation and analysis (need the training) –

Internal Audit (need the training) THE

MICRO CREDIT SCHEME PROPOSAL 1.

The target group : Poor

women in the rural areas 2.

Economic sector :

Agriculture, services, small enterprise 3.

Size of loan

: Depends on the purpose of loan are the ability of the borrower

to repay the loan (learned from BRI) concentrate on the small size 4.

Non – collateral 5.

Interest Rate

: 1%/month (…) 6.

Monthly installment (as current scheme) 7.

Lending Scheme: -

Group lending (as current) -

Individual lending (learned from BRI) -

Test the effect – evaluate – make recommendation – change the

policy 8.

Computerized the micro credit management system (as current) 9.

The organization structure (learned from BRI and combined with the current

structure)

(Manager: Marketing, Operational, Business

Micro Manager Assistant manager…..Micro Banker Users)

(Unit

Manager, Credit Officers, Deskman) Timeframe

Daw

Po Po Ky

Myanmar

National Committee for Women’s Affairs (MNCWA), Myanmar THE

ACTION PLAN I

would like to mention briefly about the Action Plan. First

forward I would like to present you about Myanmar National Committee for

Women’s Affairs (MNCWA). I am one of the members of MNCWA. It was established

on 3rd July 1990, to systematically carry out the activities for the

advancement of women. The main objective of this committee is to promote the

advancement of women especially for those at the grass-root level. MNCWA

played a major role in enhancing women’s development by giving loan for micro

enterprise activities. The sub – committee give small loans to women in rural

areas without collateral. Women

are given small loan to small business for fruit preservation and tailoring. In

other words, loan are given for various micro enterprises to meet local needs. The

main objectives of micro credit scheme are to alleviate poverty, to empower and

strengthen women in small business. Now

our Action Plan is this. Hence, the Action Plan will enhance the development of

small enterprises in our country. Proposed

Micro Credit Scheme which will are enhanced 1.

Technical Assistance 2.

Business loans for industry 3.

Training

By:

Gerry T. Lab-oyan, Philippines A.

Background of Micro Finance Program Ø

Cooperative Bank of Benguet (CBB) is a rural bank financial institution

organized by cooperative societies in Benguet, Philippines, in 1992 Ø

CBB offers savings and small loans: small agriculture loans, small

industrial loans, small commercial loans, petty traders/vendors loans,

fixed salaried employees loan Ø

In 1995, CBB offered micro finance service targeting indigenous poor

women Ø

The microfinance program is called Highland Micro Finance Program B.

Objective of micro finance program Ø

mobilize small savings from poor households Ø

contribute to the establishment of family based micro enterprises Ø

support the development or expansion of existing family based micro

enterprises C.

Brief description of existing micro credit scheme The

Highland Micro Finance Program of Cooperative Bank of Benguet has two

schemes: I

Center for Women Development Program Ø

developed from Grameen Bank Model Ø

group loan approach, women clients only Ø

minimum 3 groups and maximum 6 groups at 5 members per group (15

members to 30 members) Ø

7 days compulsory training Ø

weekly meetings, weekly amortization o no collateral Ø

loan amount range from US$60-$160, 6-12 months term o

24% interest rate (flat) per annum 2.

Self-Help Group Development Program Ø

targeted to existing informal self-help groups in the villages or

communities Ø

members per informal group usually ranges from 7 to 20 individuals,

mostly dominated by women Ø

group loan approach Ø

basic requirement for loan access: started or with existing savings

generation activity Ø

weekly, bi-weekly or monthly meeting and amortization o

no collateral Ø

I day orientation seminar Ø

loan amount ranges from US$100-$200 per borrower, 4-6 months term Ø

24% interest rate (flat) per annum D.

Proposed Enhancement of Micro Finance Program

By:

Gerry T. Lab-oyan, Philippines

Jeffrey

R. Ordoiiez

People's Credit and Finance

Corporation Philippines NAM

CSSTC REGIONAL TRAINING ON MICRO CREDIT SCHEME ACTION PLANS I.

BACKGROUND: The People's Credit and Finance

Corporation (PCFC) is a state owned and controlled corporation mandated

by law to be the lead entity for the development of the microfinance

industry in the Philippines. Created in September 1995 under an

executive order of President Fidel V. Ramos, the PCFC was tasked to

provide credit to the poor. In 1997, the Social Reform and Poverty

Alleviation Act was passed by the Philippine Congress that mandated PCFC

as the lead entity for microfinance. The PCFC is basically a wholesaler of

funds to microfinance institutions (MFIS) for relending to

micro-entrepreneurs. It provides both investment credit (used for

re-lending) and institutional credit (used for capability building) to

Non-Government Organizations (NGOs), Cooperatives and Cooperative Bank,

Rural Banks, Thrift Banks, and People's Organizations (POs). As of July 2002, PCFC has a total of

199 active conduits (65 cooperatives, 31 NGOS, 2 lending investors, 23

cooperative banks, 73 rural banks, and 3 thrift banks) covering the

three major islands of the Philippines (Luzon, Visayas, and Mindanao).

Each MFI has an extensive network of branches and operation units

covering around 90% of all towns in the Philippines

- The PCFC has two major lending

programs, the HIRAM (Helping Individuals Reach their Aspirations through

Microcredit) Lending Program (HLP) and the Rural Micro Finance Project (RMFP)

funded by the Asian Development Bank (ADB) and the International Fund

for Agricultural Development (IFAD). PCFC's target end-clients are

Filipino families earning less than US $100 a month in rural areas and

US $150 in urban areas. These families are granted a scaled up loans

starting from $20 to $500. Soon, PCFC shall begin granting loans

to MFIs that shall be used to finance end-clients who have graduated

from US $500 loans. Maximum amount of loans to be granted to individual

borrowers shall be US $3,000. This shall be funded through loans

obtained from the World Bank (WB) and the Spanish government. Aside from lending to MFIS, PCFC also

leads in the development of the microfinance industry in the

Philippines. Aside from granting loans to MFIs for capability building,

PCFC also provides technical assistance and trainings. Technical assistance is given

directly to MFIs through PCFC's Account Officers. While special

trainings are conducted for MFIs either through PCFC Account Management

Teams or through accredited training institutions. PCFC, with a grant

from the Spanish government, also provides free trainings to MFIs to

develop management capabilities and to enhance human resource programs

and organizational systems. II.

MICROFINANCE PROGRAM OBJECTIVES: PCFC's objective is to provide credit

to poor Filipinos and to alleviate them from poverty. Its immediate

objective is to serve a total of I million poor families by the end of

2004. As of July 2002, PCFC has served a

total of 659,140 poor families all over the Philippines. III.

MICRO CREDIT SCHEMES: Majority of PCFC conduit MFIs follow

a modified Grameen Bank Approach (GBA), which is proven to be more

suitable under the Philippine setting. GBA is most commonly implemented

in the rural areas while individual lending is implemented in urban

areas and centers of commerce of rural towns. There is a clear segregation of

market for both individual and group lending methodologies. Group

lending using GBA is concentrated in serving rural folks in barangays

(sub-districts). Loans start from as low as $20 - $120 and gradually

increasing in each loan cycle depending on the borrower's repayment

capacity. The loan is used to finance livelihood projects and micro

businesses which may also include start-up businesses. As for individual lending, the target

market are the urban poor entrepreneurs and micro- enterprises found in

the commercial districts of rural towns. Those who graduate from $500

loans and those who have transformed their livelihood projects into

sustainable micro-enterprises may start borrowing individually from the

MFIS. IV.RECOMMENDATIONS:

The KUPEDES and SIN4PEDES/SIMASKOT

schemes are interesting case studies for Philippine MFI'S. The loan and

business evaluation procedures of KUPEDES and the savings generation

schemes of Bank BRI may prove to be beneficial to Philippine MFIS. The

schemes would complement PCFC's program that would finance individual

borrowers and group loan graduates. The following are therefore

recommended: 1.

Regular regional micro credit trainings and exposure to Bank BRI

to allow the participation of key Philippine MFIs and to give them the

opportunity to see first hand the best practices of Bank BRI. 2. Regular regional

forums for the exchange of ideas and best practices in microfinance as

well as a forum to discuss regional development concerns. 3. Exchange

programs wherein MFIs and their regulating agencies may be able to study

and see first hand the microfinance best practices of other countries.

As for PCFC, such regional exposure shall enhance technical assistance

provision to Philippine MFIS. 4. Training grants

to PCFC Account Officers (AO) who are directly involved in the direction

setting and provision of technical assistance to MFIs in the

Philippines. It will be beneficial for PCFC's AOs

to review first hand the operating systems of Bank BRI and other

successful MFIS. The review should focus on internal control systems,

staff training and development programs, monitoring and management

information systems aside from the lending and savings methodology. Exposure to other successful MFIs in

Asia and in Africa / Latin America (such as FIE/PRODEM/Banco Sol of

Bolivia) and other similar organizations as PCFC servicing MFIs (such as

NABARD or PTKF) would be beneficial as well. Likewise,

study grants for microfinance in Boulder, Colorado, USA would be highly

beneficial. Capability building is important for

the success of any microfinance program. However, funding for such

purpose is limited. Should NAM CSSTC consider these recommendations and

sponsor such trainings/study and exposure, it would contribute greatly

to the' development of microfinance in the Philippines and in the Asian

region and other NAM member countries as well. NB: * Should there be future regional

trainings / forums sponsored by NAM CSSTC, the NAM CSSTC may coordinate

such events through PCFC who can provide a list of recommended

Philippine MFIS.

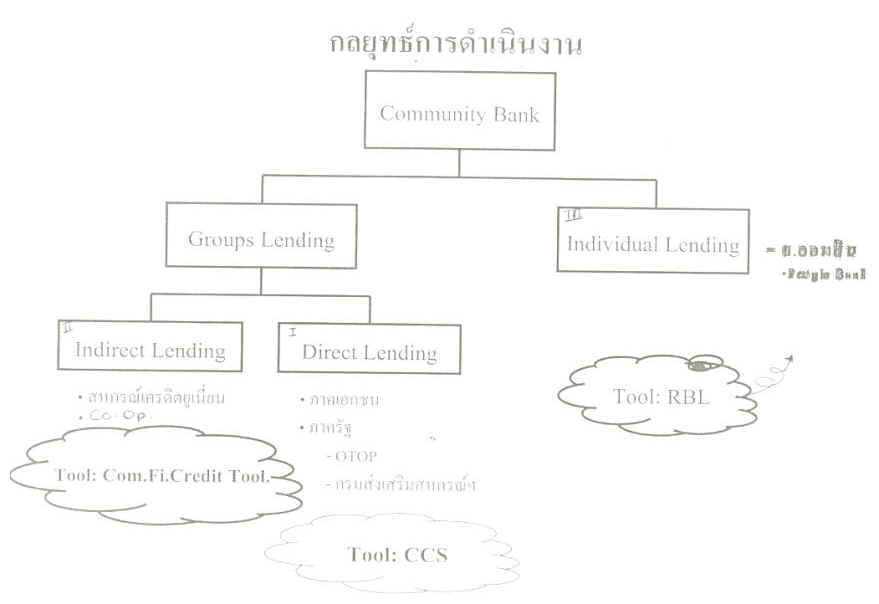

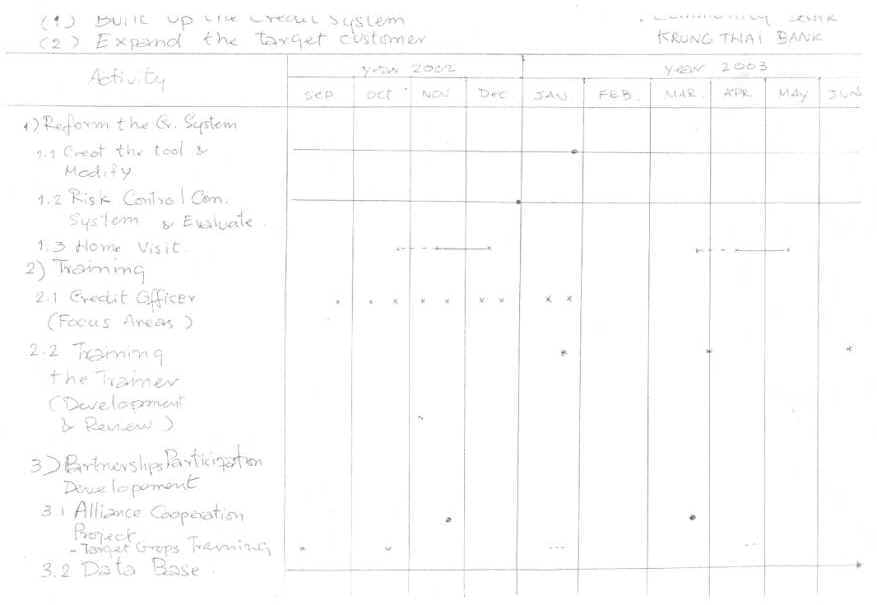

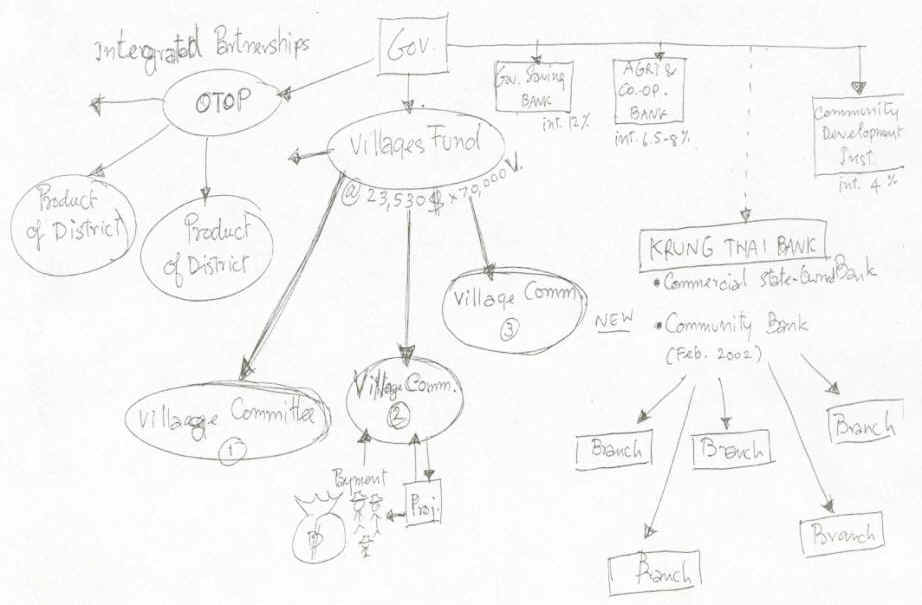

Nisanard,

Yothasmut

Krung

Thai Bank Community

Bank Krung

Thai Bank (Public) Limited, as one of state-owned commercial banks, has

an important role in taking part in supporting and promoting the

development of community potential. KTB coordinates its efforts with

cooperation of it’s business alliances. including state, private, non-government organizations (NGOs), and other independent

organizations in building economic strength and capability of all

community, which is an essential foundation of our national economic

system. KTB has not only customers in both state and private sectors,

but also skills and specialty in providing financial services for

business sector. KTB, thus, has an ability to develop the coordinating

system extending the revenue production process of comm4Tl!y to a

complete circle that w effectively strengthen community foundation

continuously from production through export. This is an important strong

point of KTB that is different from other organizations working with

community. As

a result,, KTB established its Community Banking in February 2002. This

unit will support community financial services, especially funding, and

also coordinate a development of knowledge in production,. management

and marketing, etc., for community from various sources with cooperation

from its business alliance organizations. Credit

Policy Community Bank will give credit to

community using following approaches. Ø

Our

target customers are community groups or community networks that are

formed to make products or to conduct activities that produce benefits

and revenue, and also that are sufficiently strong to prevent risk to

business of customers and the bank. Ø

Approach.

There are two channels of approach, including; 1.

Mobile Unit Teams from KTB Community Bank that will travel to provide

financial services in the fields. 2.

Credit Teams from KTB branches across the country that will provide

financial services to customers in their areas. There will be an

assessment of community needs to insure that credit is appropriately

provided to meet the needs of community groups. Ø

Credit

Lending Tools. Community Bank has developed the Community Credit Scoring

model to be used to analyze and assess community groups. The credit will

be given to Ø

community

groups with lending interest as according to risk. Factors to be used

for assessment include organization facts, management, production,

marketing, and financial status of the community groups. Ø

Approval

Authority. In order to prudently and efficiently provide lending to

successfully achieve the bank's policy, KTB has established the

Community Credit Committee responsible for setting lending criteria, and

controlling and screening loan according to those set criteria. The

Committee has authority to approve lending credit of 50 Million Bahts.

The Committee is also responsible for overseeing management of

non-performing loans resulted from the lending.

|